All Categories

Featured

Table of Contents

Term plans are likewise usually level-premium, yet the excess quantity will continue to be the very same and not grow. The most typical terms are 10, 15, 20, and three decades, based upon the demands of the insurance holder. Level-premium insurance policy is a kind of life insurance policy in which premiums remain the very same rate throughout the term, while the amount of coverage provided boosts.

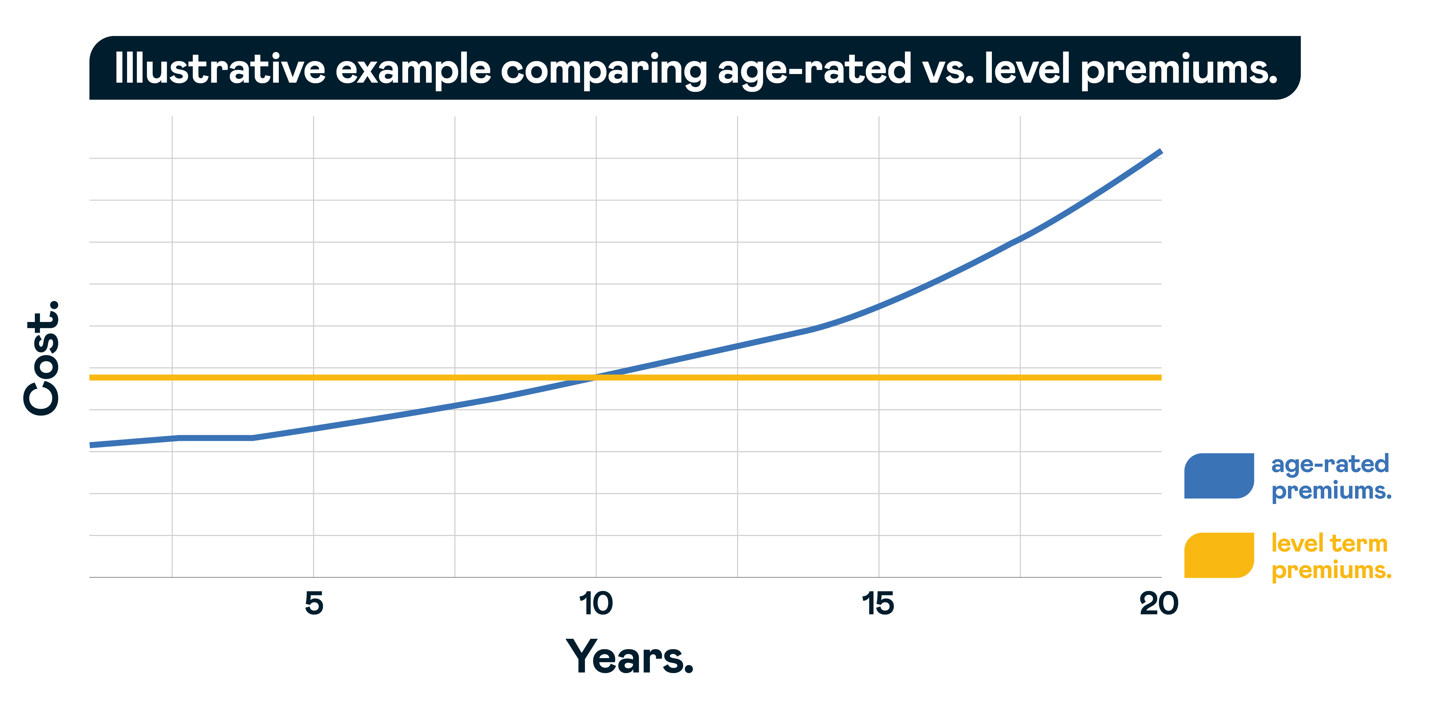

For a term policy, this suggests for the size of the term (e.g. 20 or 30 years); and for a long-term plan, till the insured dies. Level-premium policies will typically cost even more up-front than annually-renewing life insurance policies with regards to just one year at a time. Over the lengthy run, level-premium payments are usually extra affordable.

They each look for a 30-year term with $1 million in protection. Jen acquires an assured level-premium plan at around $42 monthly, with a 30-year horizon, for a total of $500 per year. Beth numbers she may just require a plan for three-to-five years or until complete payment of her existing debts.

In year 1, she pays $240 per year, 1 and about $500 by year five. In years 2 through 5, Jen remains to pay $500 monthly, and Beth has actually paid a standard of just $357 annually for the same $1 countless protection. If Beth no more requires life insurance policy at year 5, she will have conserved a great deal of money about what Jen paid.

How Does Annual Renewable Term Life Insurance Protect Your Loved Ones?

Every year as Beth obtains older, she faces ever-higher annual premiums. Jen will continue to pay $500 per year. Life insurers have the ability to supply level-premium plans by basically "over-charging" for the earlier years of the plan, accumulating more than what is needed actuarially to cover the threat of the insured passing away throughout that early period.

Irreversible life insurance policy develops money value that can be borrowed. Policy loans accumulate passion and overdue plan car loans and rate of interest will certainly lower the survivor benefit and cash value of the plan. The amount of cash worth available will typically depend upon the kind of irreversible policy bought, the amount of protection purchased, the length of time the policy has actually been in force and any outstanding plan fundings.

Disclosures This is a basic summary of protection. A complete statement of insurance coverage is discovered only in the plan. For more details on insurance coverage, costs, limitations, and renewability, or to look for insurance coverage, contact your neighborhood State Farm representative. Insurance coverage and/or connected bikers and functions might not be offered in all states, and plan terms may vary by state.

Degree term life insurance coverage is the most simple method to obtain life cover. In this write-up, we'll explain what it is, just how it functions and why level term may be best for you.

How Does Simplified Term Life Insurance Work?

Term life insurance is a kind of plan that lasts a certain size of time, called the term. You pick the size of the policy term when you first take out your life insurance policy.

Select your term and your amount of cover. You may need to address some questions regarding your medical history. Select the plan that's right for you - Voluntary term life insurance. Currently, all you have to do is pay your costs. As it's level term, you understand your premiums will certainly stay the exact same throughout the regard to the plan.

Life insurance coverage covers most scenarios of fatality, yet there will be some exclusions in the terms of the policy.

Hereafter, the plan finishes and the making it through partner is no longer covered. Individuals frequently secure joint plans if they have exceptional monetary dedications like a home loan, or if they have kids. Joint plans are usually much more inexpensive than solitary life insurance coverage policies. Other kinds of term life insurance policy plan are:Decreasing term life insurance coverage - The quantity of cover decreases over the length of the policy.

What Makes Level Premium Term Life Insurance Policies Unique?

This safeguards the purchasing power of your cover quantity versus inflationLife cover is a fantastic point to have due to the fact that it offers economic protection for your dependents if the worst happens and you pass away. Your enjoyed ones can likewise use your life insurance policy payout to spend for your funeral. Whatever they select to do, it's great tranquility of mind for you.

Level term cover is great for satisfying daily living costs such as home costs. You can likewise utilize your life insurance policy benefit to cover your interest-only mortgage, repayment home loan, school costs or any other financial debts or recurring settlements. On the various other hand, there are some drawbacks to level cover, contrasted to various other sorts of life plan.

Term life insurance policy is an affordable and straightforward choice for many individuals. You pay costs monthly and the insurance coverage lasts for the term size, which can be 10, 15, 20, 25 or 30 years. Increasing term life insurance. What takes place to your premium as you age depends on the kind of term life insurance coverage you acquire.

What Does Level Term Life Insurance Meaning Provide?

As long as you remain to pay your insurance premiums every month, you'll pay the very same rate during the entire term size which, for lots of term policies, is normally 10, 15, 20, 25 or three decades. When the term ends, you can either choose to finish your life insurance policy protection or renew your life insurance coverage plan, normally at a greater rate.

For instance, a 35-year-old woman in outstanding health and wellness can get a 30-year, $500,000 Place Term policy, provided by MassMutual beginning at $29.15 each month. Over the next thirty years, while the policy remains in location, the expense of the coverage will not transform over the term period - Simplified term life insurance. Let's admit it, a lot of us don't such as for our expenses to grow with time

Your level term rate is figured out by a variety of aspects, a lot of which are associated to your age and wellness. Various other elements include your details term policy, insurance provider, benefit quantity or payout. Throughout the life insurance policy application process, you'll address questions concerning your wellness history, including any pre-existing conditions like a crucial illness.

Latest Posts

Burial Plans For Seniors

Final Expense Insurance Florida

Burial Policy Insurance